Services

Empowering Your Financial Freedom

At Nortax, we believe in delivering far more than numbers. We aim to provide financial clarity, control, and peace of mind. Through expert planning, preparation, and proactiveness, we ensure you can focus on what truly matters – running your business, leaving all the complex financial processes to us.

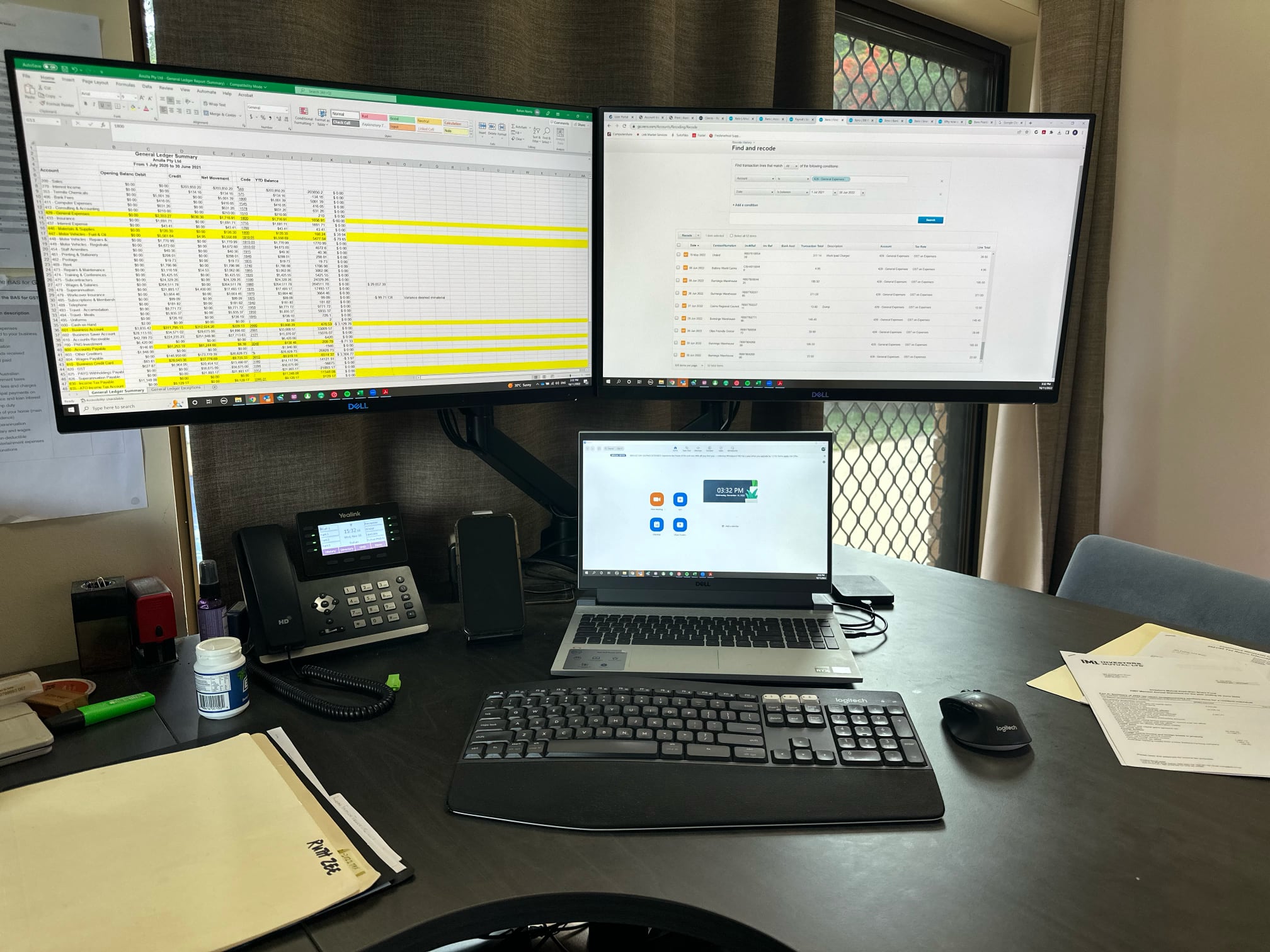

Accounting and Reporting

We are committed to alleviating you of the tedious, time-consuming tasks of compliance, payroll, and bookkeeping. Our streamlined approach ensures the timely delivery of Business and Instalment Activity Statements while assisting you in keeping track of crucial due dates.

Our core services include:

- Comprehensive financial statement preparation

- Crafting special purpose reports

- Managing statutory entities

- Project and job costing

Taxation Services

Whether your taxation needs are simple or complex, our team of seasoned tax professionals will simplify the process, meticulously preparing your financial statements and tax returns. We leverage our extensive expertise to take the uncertainty out of tax planning, and maximise your returns.

Our tax-related services include:

- Advanced tax planning

- Efficient preparation of income tax returns

- Expertise in fringe benefits Tax return

- Detailed quarterly BAS Statement preparation

- CGT advice

- Land Tax advice

- Comprehensive tax audit support and advice

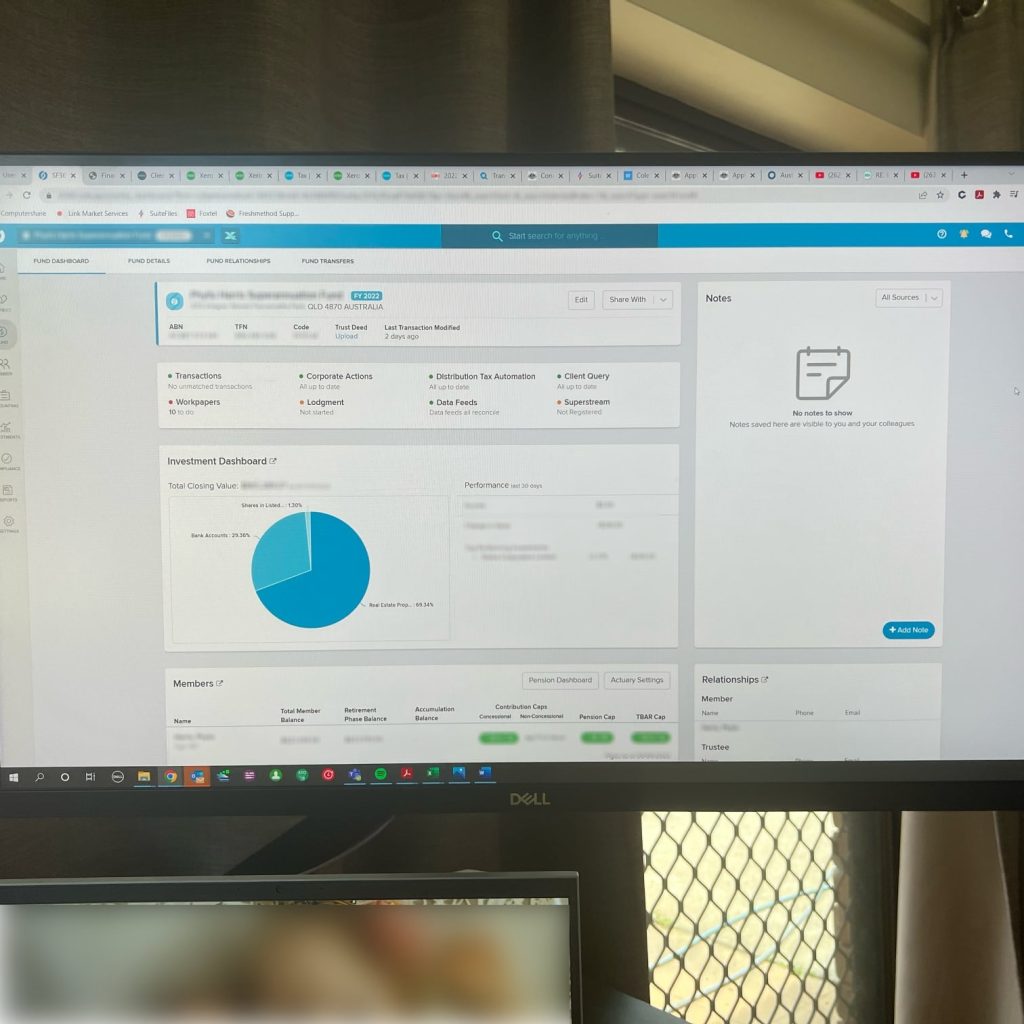

Self-Managed Superannuation Fund (SMSF)

At Nortax, we specialise in the ongoing administration of your SMSF. From setting up to ensuring compliance with all your reporting requirements under the SIS Act, we take the stress out of the process.

Our dedicated SMSF services include:

- Seamless SMSF Creation

- Continuous SMSF Administration

- Personalised SMSF Consultation

- Detailed SMSF Audits

Business Advisory Services

Nortax is not just about accounting. We are your business expansion and diversification partners. Our business advisory services ensure smooth transition into retirement, with expert business valuations.

We provide professional advice around:

- Income Tax

- GST

- Capital Gains Tax

- Fringe Benefits Tax

- Management of rental properties

- Self-managed superannuation funds

- GST, FBT, TFN, FTC registrations

Audit Services

We take pride in delivering high-quality auditing services. Our offerings include audits of Self-Managed Superannuation Fund (SMSF), Real Estate Trust Accounts, and Not-for-Profit Corporations.

Our audit services include:

- Audits of Self-Managed Superannuation Funds (SMSF)

- Real Estate Trust Account audits

- Not-for-Profit Corporation audits

- Comprehensive financial statement audits

- Compliance audits for regulatory requirements

New Business Owners

For budding entrepreneurs, we provide the guidance and tools necessary to successfully navigate through the financial landscape of your new business, implement efficient bookkeeping systems, and make informed financial decisions.

Our services for new business owners include:

- Implementation of efficient bookkeeping systems

- Business structure advice and setup

- Financial forecasting and budgeting

- Tax planning and compliance guidance

- Business registration assistance

- Initial financial strategy development

- Ongoing financial mentoring and support

Small and Medium Business

As your trusted partner, we understand that you need more from an accountant than just compliance. We’re here to provide business planning, bespoke advice and support, enabling you to realise your business and financial goals.

Our tailored services for small and medium businesses include:

- Strategic business planning and advice

- Cash flow management and optimization

- Profit improvement strategies

- Growth and expansion planning

- Risk assessment and management

- Performance benchmarking